It’s a common misconception that home appraisals and home inspections are “essentially the same thing.” In reality, they are very different—but equally important in the home buying or selling process as both are needed in order to close.

Whether buying or selling a home, appraisals and inspections are a vital part of the process. A home for sale is a product that needs to be thoroughly evaluated structurally and in market value in order to be sold. This is where appraisals and inspections come into play.

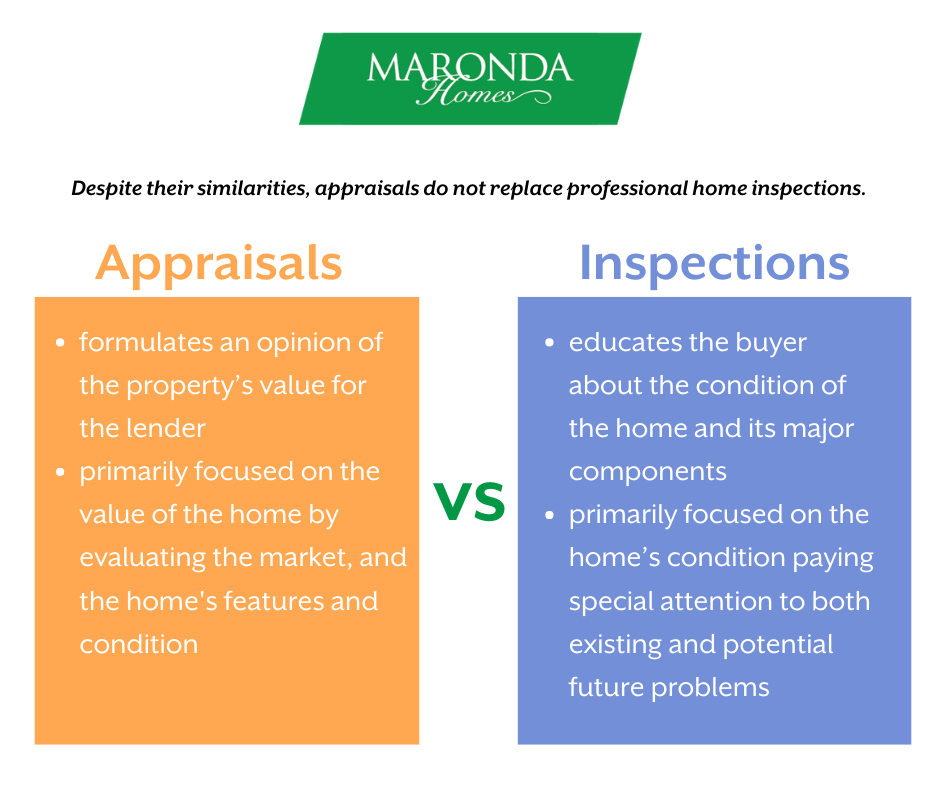

Appraisals vs. Inspections:

What is an appraisal, and why do you need one?

A home appraisal is an unbiased professional opinion of a home’s value. When purchasing a home, an appraisal determines if the contract price is appropriate by evaluating its condition, location, and features.

To accurately conclude the property’s value, the appraisal process consists of internal research and a visual interior and exterior inspection of the home. An appraiser will look at recent sales of similar properties nearby, as well as current market trends and conditions. They will also take into consideration details of the home, including its size, condition, floor plan, and amenities.

Although appraisers provide valuable information to buyers and sellers (ie: they can help homebuyers avoid overpaying for homes), their primary mission is to protect lenders. Lenders want to make sure that homeowners are not overborrowing as the home will serve as collateral for the mortgage. Therefore, to avoid owning overpriced properties, lenders require an appraisal before giving the buyer a loan approval.

What is an inspection, and why do you need one?

A home inspection is an in-depth assessment of a home’s current condition. When purchasing a home, an inspection is highly recommended as it provides a thorough assessment of the home’s overall safety and livability.

A qualified home inspector will assess components such as heating and cooling systems, plumbing, electrical work, water, sewage, and fire and safety issues. They will also look for evidence of insects, water, fire damage, or any other issue that may affect the property’s value.

Appraisals and Inspections in New Home Construction

At Maronda, we have several inspections during the building process, which we provide for the homebuyer. Inspections here happen during the framing, plumbing, and electrical processes, up until the pre-settlement walkthrough.

To close, the home must pass all the inspections mentioned above and receive a Certificate of Occupancy—a legal document verifying the property is up to code and safe to live in.

As a home buyer, you may also choose to get a final inspection on top of ours at your discretion.

Appraisals and inspections are crucial components when purchasing or selling a home. Not only do they help you dictate the value and safety of the home, but they are also needed in order to close. When building with Maronda and financing with our preferred lender, RMC Home Mortgage, we ensure your home is properly appraised and inspected every step of the way.